are assisted living facility fees tax deductible

Unfortunately many people do not realize that. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of.

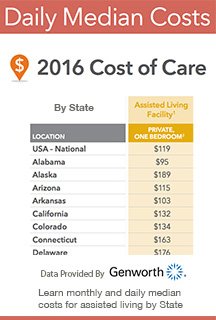

2022 Assisted Living Costs And Pricing By State

Deducting Assisted Living Expenses.

. Long-term care services are tax-deductible expenses on Schedule A according to the 1996 Health Insurance Portability Accountability Act. The only time when room and board can be deducted is when the senior is chronically ill. For some residents they might enjoy a tax deduction of the entire monthly fee while some might only get a deduction for the expenses that some specific personal care.

Often times the assisted living facility can provide a breakdown of which fees are considered eligible. However if the resident is chronically ill and residing in the. Generally only the medical component of assisted living costs is deductible and ordinary living costs like room and board are not.

Most of the time assisted living costs are tax-deductible. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care. Assisted living expenses qualify as deductible medical expenses when the.

The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction. Assisted living expenses are deductible when a doctor has certified a patient cant care for themselves. Special rules when claiming the disability amount.

Depending upon Moms condition and with a bit of planning the assisted living facility costs might be tax deductible. In some circumstances adult. The everyday living costs such as room and board are not tax-deductible.

There are special rules when claiming the disability amount and attendant care as medical expenses. Yes in certain instances nursing home expenses are deductible medical expenses. Yes assisted living expenses are tax-deductible.

According to the Internal Revenue Service IRS taxpayers are allowed to deduct the cost of assisted living partially or in full if you qualify. The Health Insurance Portability and Accountability Act also known as HIPPA directs that qualified long. For example housing fees are not tax deductible unless your loved one resides in an assisted.

For information on claiming. If you are paying for a loved ones assisted living costs they are quite likely considered chronically ill. The medical expenses that.

Under limited circumstances adult children. The assisted living facility is responsible for providing residents with information as to what portion of fees is attributable to medical costs. There are certain expenses that are prohibited from being tax deductible.

The fact is that the IRS has stated that any qualifying medical expenses that total more than 75 of your adjusted gross income can tax deductible. Are Assisted Living Facility Cost and Expenses Tax Deductible. The assisted living facility is responsible for providing residents with information as to what portion of fees is attributable to medical costs.

If you your spouse or your dependent is in a nursing home primarily for medical. Which assisted living costs are tax deductible. He just might be in luck however.

Are Assisted Living Expenses Tax Deductible Medical Expense Info

How To Deduct Assisted Living And Nursing Home Bills Hesch Cpa

Assisted Living Costs 2022 Trends By State Type Of Care

Are Assisted Living Costs Tax Deductible Ask After55 Com

Deduct Expenses For Long Term Care On Your Tax Return Kiplinger

Things To Remember At Tax Time

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Costs Expenses And How To Pay For Assisted Living

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Is Senior Living Tax Deductible Here S What You Can Claim

Caring For Your Parents Help Is On The Way Chapter 10 Money Smart Women Ppt Download

2022 Assisted Living Costs And Pricing By State

The 4 Best Assisted Living Facilities In Jasper Ga For 2022

Can I Deduct Medical Expenses I Paid For My Parent Agingcare Com

![]()

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

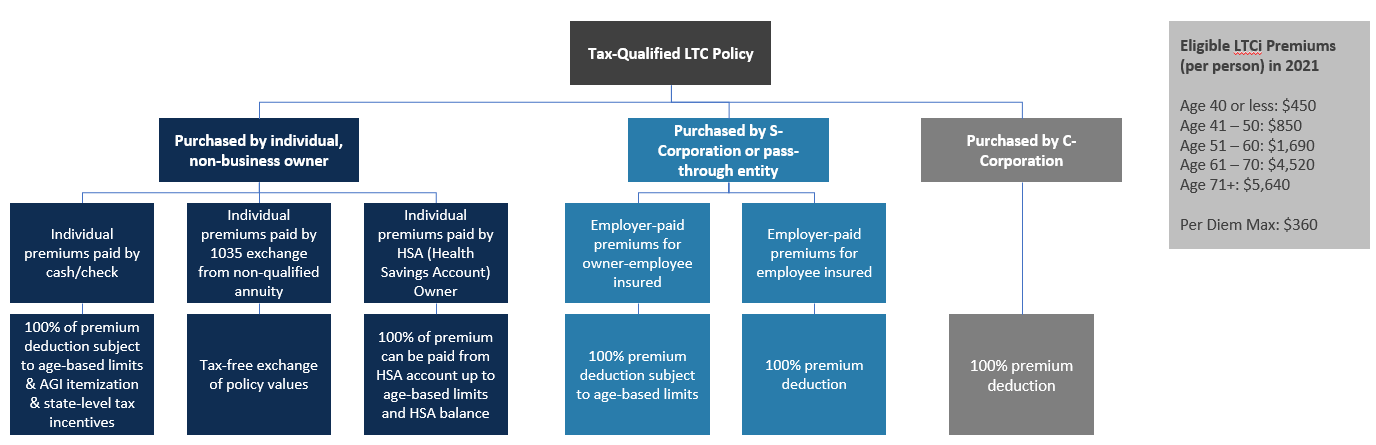

Surprising Tax Benefits Of Long Term Care Aht Insurance

Tax Time Tips For Caregivers Of Alzheimer S Patients The Lasalle Group